Strategy & Scale #008

"When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact." - Warren Buffett

I co-lead software investing at KDT. Our team invests directly from the balance sheet of Koch Industries, one of the largest companies in the world. We work closely with the company’s vendors and customers, who look to KDT for introductions to tech companies that will transform their businesses.

Please reach out if you think there is mutual benefit (jon.galitzer@kochind.com). Thanks for reading.

A Thought

We’re in the first innings of AI-enabled productivity gains, but I’m not sure I agree with consensus on where the ‘value capture’ will land. This is the first post of many hitting on R&D in the context of AI efficiencies.

R&D capital allocation is hard. Most software businesses commit heavy, upfront R&D spend - this is a feature, not a bug, and lies at the core of what drives disruptive innovation. The R&D cost bucket - predominantly labor cost - quickly benefits from operating leverage as customer count grows.

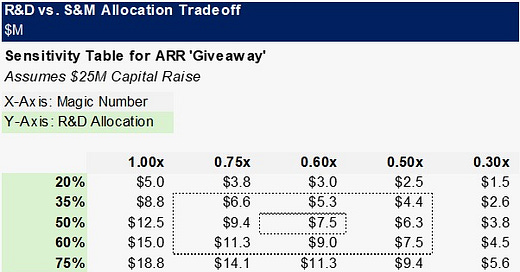

The first thing we’re taught in Econ 101 is that resources are scarce. This is true in the world of startups, where each fundraise defines the available resources to achieve key milestones. To help drive better discussions on capital allocation, I use a framework I call the ‘One Dollar Framework’ that lands surprisingly well with founders: Every dollar spent on R&D is a dollar not spent on S&M.

And here’s the math:

With R&D, a founder and their board make an active choice to sacrifice sales today for ‘future economics’ (stemming churn, enabling upsell, growing switching cost, etc). Implicitly, teams understand the “ARR giveaway”, but few quantify the tradeoff.

Things to Read

On Growth Frameworks: “Finance owns the flow of cash in and out of a company. Growth owns the flow of customers in and out of a product … Startups will build a really robust finance organization, but not a team with the responsibility to measure, understand and improve the flow of users in and out of the product and business.” - Andy Johns

On Fixing Teams: “Complexity is the spawn of incompetence, and incompetent teams often spin webs of complexity that make it extremely difficult for outsiders to engage … Nobody really knows what the truth is, what good looks like, whose fault anything is. People are angry and nothing ever seems to fix it … Blurred lines of ownership are often major catalysts for toxic teams. ”- Stay SaaSy

On Keeping Strategy Simple: “Great product companies have four things in common: a clear product vision; a product strategy; a set of priorities; and a way to measure outcomes … Product Strategy is a fancy way of saying, “this is how we will behave day-to-day to accomplish our end goal” … What validated problems will your product solve for your users or customers. What experience and emotions will your product and brand convey … The team also needs to be held accountable for what they prioritize. Metrics help you understand what’s working and what’s failing.” - Richard Banfield

On Sales + Marketing Jiving: “Most marketers have never been in sales, and most folks in sales have never worked as marketers. In larger companies, the teams often don’t even interact that much … Some teams will resist attempting to build a story because they believe every pitch should be completely customized for the prospect they are talking to … In general, Consistency trumps customization in very early sales interactions.” - April Dunford

On Collaborating Better: “Parkinson’s Law is the adage that “work expands so as to fill the time available for its completion … The amount of time allotted to any task determines how long the task takes.” - Griff Foxley